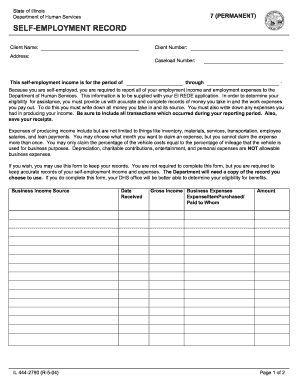

Who needs a Self-Employment record?

This form is completed by individuals who are self-imployed in Illinois. They should report all their income and expenses to the Department of Human Services.

What is the purpose of the Self-employed record?

The information provided in the form is used by the Department of Human Services to determine the eligibility of the self-employed person for assistance. The record contains important data about the source of the business income, amount of expenses, etc. This form is not obligatory, but self-employed people have to keep records of the income and expenses anyway. The form is also used by the DHS to determine eligibility for benefits.

Is the Self-Employment record accompanied by other forms?

This form is usually accompanied by receipts of the transactions.

How long does it take to fill the Self-employed record out?

The estimated time to complete the form is 15 minutes.

What information should be provided in the Self-employed record?

The record provides the information about the self-employed person (name, address), the duration of the record period, the business income source, date received, gross income, business expenses paid to whom, and amount in dollars.

What do I do with the Self-Employment record after its completion?

The record can be kept for the personal use of the self-employed person, or it can be forwarded to the Department of Human Services.