Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

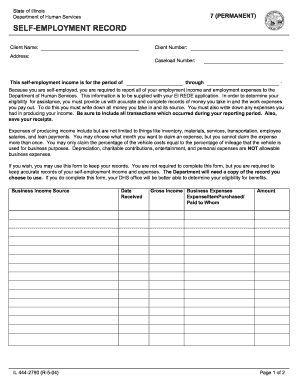

Form IL-444-2790 is an Illinois Department of Human Services application form for the Supplemental Nutrition Assistance Program (SNAP).

Who is required to file form il444 2790?

Form IL-444-2790 is a tax return form for individuals who are required to file a return in the state of Illinois. The form is typically required for individuals who are residents of Illinois, part-year residents, nonresidents, and those claiming a tax credit for taxes paid to another state.

What is the purpose of form il444 2790?

Form IL-444-2790 is the Illinois Department of Revenue's Business Registration Application. It is used to register businesses with the State of Illinois for the purpose of collecting and remitting state taxes.

When is the deadline to file form il444 2790 in 2023?

The deadline to file Form IL-444-2790 in 2023 is April 15th.

How to fill out form il444 2790?

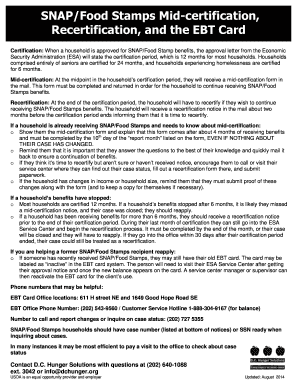

Form IL444-2790 is the Application for Benefits Eligibility (ABE) Redetermination form. It is used in Illinois to renew and update eligibility for public assistance programs such as medical assistance, Supplemental Nutrition Assistance Program (SNAP), and Temporary Assistance for Needy Families (TANF). Here are the steps to fill out the form:

1. Start by providing the requested personal information in Section 1. This includes your full name, address, contact information, and Social Security number.

2. In Section 2, you will need to indicate the programs for which you are seeking redetermination. Check the appropriate boxes for the programs you are renewing, such as medical assistance, SNAP, and TANF.

3. Section 3 asks about household composition. Provide the requested details about all individuals living in your household, including their names, relationship to you, and Social Security numbers.

4. Section 4 deals with income. Provide information about your income and the income of everyone in your household. This may include earnings from employment, Social Security benefits, pensions, child support, and other sources of income. If someone in your household does not have any income, mark the appropriate checkbox.

5. In Section 5, report any changes or updates in your household, income, or circumstances since your last application. This is important for the redetermination process, as it helps the state determine your continued eligibility.

6. Section 6 is for signing and dating the form. Make sure all required fields are filled out, and sign and date the form.

7. After completing the form, make a copy for your records and submit the original to the appropriate local Illinois Department of Human Services (DHS) office. You can find the correct office address on the website or by calling the DHS helpline.

Ensure that you provide accurate and up-to-date information on the form. If you have any questions or need assistance, it's recommended to contact the Illinois Department of Human Services or seek help from a local social service agency.

What information must be reported on form il444 2790?

Form IL444-2790, also known as the Illinois Monthly Report of Cash Assistance, is a document used by the Illinois Department of Human Services (IDHS) to collect information about cash assistance received by eligible individuals. The information to be reported on this form includes:

1. Personal Information: The form requires the individual's name, address, case ID number (assigned by IDHS), and contact information.

2. Household Composition: It asks for details about the individuals living in the household receiving cash assistance, including their names, relationship to the head of the household, and Social Security numbers.

3. Income: The form requires reporting all sources of income received by household members during the reporting month, including wages, self-employment income, social security benefits, pensions, child support, alimony, unemployment benefits, Supplemental Security Income (SSI), and other types of income.

4. Expenses: The individual needs to report details of expenses paid during the reporting month, such as rent/mortgage payments, utilities (gas, electricity, water), property taxes, child support payments, medical bills, and child care expenses.

5. Resources: The form asks for information about the value of certain assets, such as savings accounts, checking accounts, certificates of deposit (CDs), stocks, bonds, real estate (other than primary residence), vehicles, and other resources.

6. Changes: The individual must report any changes in household composition, income, employment status, or address since the last report.

7. Signature and Certification: The form must be signed by the head of the household or their authorized representative, certifying the accuracy of the provided information.

It is essential to note that these are general guidelines, and it is advisable to consult the official instructions accompanying the form for specific details and any updates.

What is the penalty for the late filing of form il444 2790?

Form IL-444-2790 is a form used for reporting wages paid to an employee who was hired under the Work Opportunity Tax Credit (WOTC) program in Illinois. The penalties for late filing of this form may vary depending on the jurisdiction and specific circumstances. It is recommended to consult the Illinois Department of Employment Security (IDES) or a tax professional to get accurate and up-to-date information on the penalties for the late filing of Form IL-444-2790.

Where do I find form 2790?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the form il 2790 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit 2790 form in Chrome?

444 2790 self can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the 2790 self employment form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your dhs self employment form in seconds.